NFTs In Music: The Long View

In the past few months, much hay has been made online over the prospective rise of NFTs, the crypto-artistic collectibles that, depending on who you ask, are either here to wholly transform the modern digital art and music industry for good, fall out as a fad in no time, or rapidly lead to the complete destruction of the environment (if adopted widespread at the current pace they are).

While I probably don’t need to rehash the many articles explaining the definition of “fungible”, or dive too deep into how the Ethereum blockchain functions as a distributed computer, I’ve broken the conversation down into a few categories I think are helpful in dissecting the discourse around this highly anticipated technology.

THE HYPE

Even those of us with no tech or investing savvy at all surely perked up two weeks ago at the news of Grimes’ $6 million sale of digital artwork via Nifty Gateway, the internet’s eBay for premiere NFTs. Perhaps we even spat out our collective beverages last Thursday at the whopping $69 million earned at auction for Beeple’s “Everydays” art-via-NFT (pictured above). Twitter as well has been ablaze with skepticism over NFTs as a potential new way to steal IP, as the account @tokenizedtweets began systematically generating NFTs for tweets (and tweeted art) without consent of the authors, and presumably without thought for what might happen if said tweets got deleted.

It’s no surprise that after a year of meteoric crypto investing, and perhaps more relevantly, meme-investing (ala DogeCoin and Gamestop), there’s no shortage of interest and capital for getting in early on what could be a defining technology of our time. After all, knowing what we know now, who wouldn’t want to go back to 2009 and buy all the Bitcoin our post-housing-crisis wallets could afford?

The Criticism

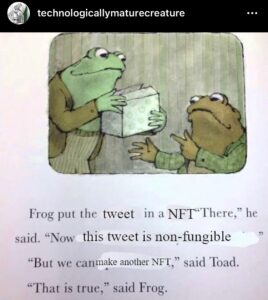

Detractors are quick to point out that these tokens are worthless in and of themselves, and amount to not much more than digital baseball cards (and in some cases, basically are), the only difference being that baseball cards don’t burn up kilograms of CO2 every time they are publicly verified. The rabbit hole goes deeper as you start to pin down exactly how the art in question gets linked to its corresponding token, and to what degree forgeries and duplicates could still exist, if not of an original work of art than of a simple screenshot of it:

Speculative investing, though, has a long history of basing price on anything other than material value. Not to mention, defining art by “material” value in the age of music streaming and P2P hardly makes sense anyway.

Given the NFT market is still largely in its infancy, and the popular Ethereum blockchain is already going through a massive renovation to mitigate it’s environmental impact, I wouldn’t be surprised if the technical intricacies of what makes NFTs viable shake out with time. To me, the larger hurdle crypto-backed artwork faces has to do with adoption.

ADOPTION

I’ll preface this section with another reference to the NFT’s blockchain-dependent cousin, Bitcoin. Many crypto investors know full well that Bitcoin, the highest-valued and most sought-after cryptocurrency to date, is simultaneously the least powerful, lacking any of the computing and smart-contract functionality that defines Ethereum and other coins, and highly inefficient (read: unsustainable), with every verified transaction relying on an increasingly outmoded “proof-of-work” computation system.

So why is a single worthless chunk of environment-destroying digital architecture worth upward of $60,000?

Because it works, and increasingly everyone is starting to use it.

The promise of the NFT, and the rocket fuel for the current NFT craze, is that for the first time since the dawn of Napster, BitTorrent and illegally burned CDs, we have technology to create digital scarcity. Sure, you may own a copy of Fleetwood Mac’s Rumors on vinyl, but what would it be like to own the original glass master, or a stake in it? Anyone can stream Lil Nas X’s entire catalog on Spotify, Apple Music or Tidal for mere dollars a month, but imagine owning a little piece of “Old Town Road”, digitally signed and secured by the artist himself, and authenticated securely on the public blockchain for anyone to see.

What’s more, modern tech music startups like TuneToken and BlueBox are seizing on the unprecedented transparency of the public ledger combined with the underlying computing power baked into the blockchain to manifest entirely new ways of thinking about digital rights, ownership and accounting in the music industry. And this is clearly only the beginning.

Final Thoughts

While fans, not speculators, will ultimately lead to the widespread adoption (or dismissal) of NFTs as collectibles and enjoy their attendant benefits, it’s the artists who have much to gain from a music industry integrated with the blockchain, if not directly from NFTs themselves. For one, a decentralized streaming model with automated payouts to artists and NFT holders would almost certainly weaken the iron grip of services like Spotify and Apple Music that arose mostly as a viable alternative to digital piracy. What’s more, with the ever growing strength of artist-driven, fan-supported platforms like Bandcamp and Patreon there couldn’t be a better time for the music-and-art-loving public to embrace radical, and radically-equitable new models of direct support for artists.

Until that happens, we can still make rent off bootlegged tweets.